Icelandair press-release

- Total revenue USD 103.6 million decreasing by 81% from last year

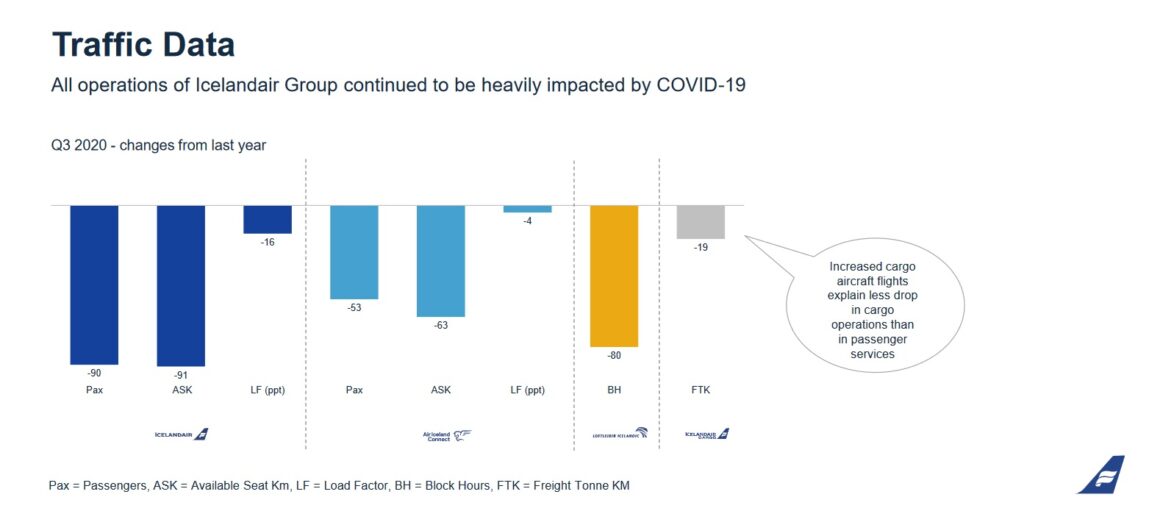

- Cargo revenues increased by 16%

- Financial restructuring successfully completed with USD 166.9 million share offering in September

- Equity USD 293.1 million at Q3 2020 end and equity ratio 26%

- Total liquidity USD 399.1 million at Q3 2020 end, thereof cash and marketable securities USD 227.1 million

- EBIT USD 3.5 million in Q3 2020 compared to USD 81.1 million in Q3 2019

- Capitalized tax loss as deferred tax assets and reclassification of jet fuel hedges, which became effective post agreements with counterparties, positively affected net profit which amounted to USD 38.2 million

- The operations will continue at minimum levels in the coming weeks

Icelandair Bogi Nils Bogason said: “Our operations continued to be negatively affected by the COVID-19 pandemic in the third quarter. Our efforts mitigated the impact during the summer where we were able to ramp up quickly when travel restrictions in some of our markets were eased temporarily. In addition, we continued to pursue opportunities within our cargo and leasing operations, increasing cargo revenue by 16%. Overall, however, we only operated nine per cent of our passenger flight schedule and the number of passengers decreased by 90% from the year before.

While we have used our flexibility to react quickly to changes in demand in the short term, we completed the financial restructuring of Icelandair Group in the quarter, strengthening the long-term competitiveness of the Company. The final step was a successful share offering in September where we raised USD 167 million in new share capital. We are thankful for the strong participation in the offering that demonstrated important support from our shareholders, new investors and the Icelandic public.

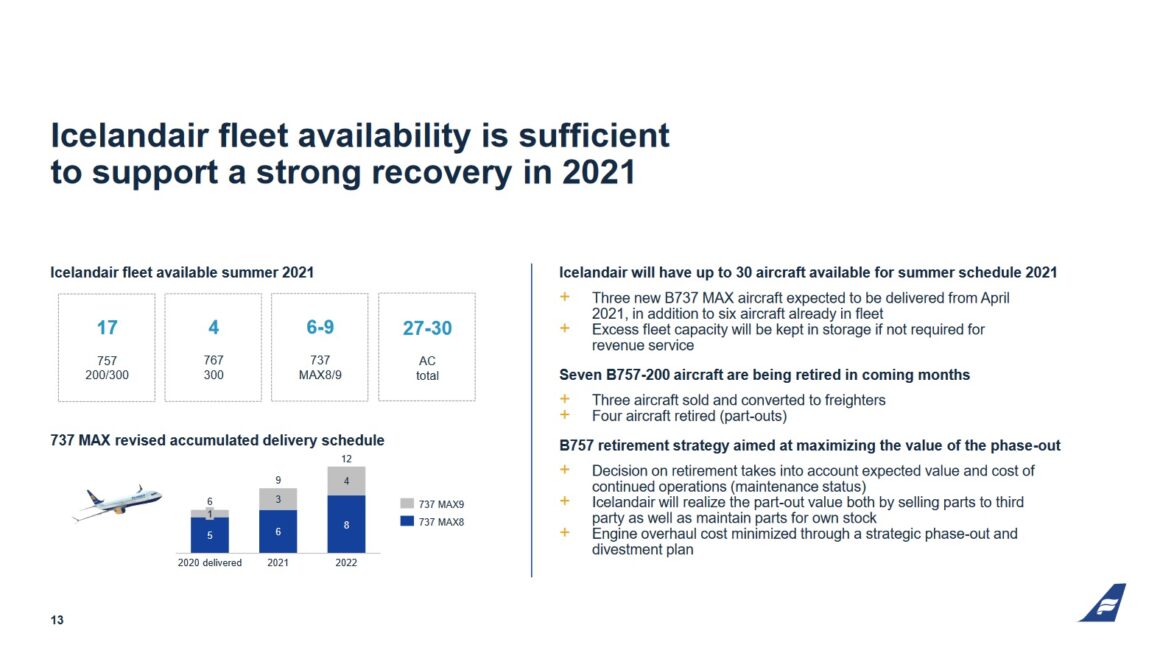

In the coming weeks, we are expecting our operations to continue to remain at minimum levels. We have minimized cash burn and strengthened the liquidity position to be able to weather the storm into 2022, if needed. However, we are focused on being well prepared to act as soon as the situation in the world improves and travel restriction in Iceland will be eased. With a broad investor base, strong balance sheet, flexible route network, robust infrastructure and great employees, we are in a good position to scale up quickly as soon as markets open again.”